Daryl Carter is the Founder, Chairman and CEO of Avanath Capital Management, a Southern California based investment firm focused on conventional and affordable multifamily investments.

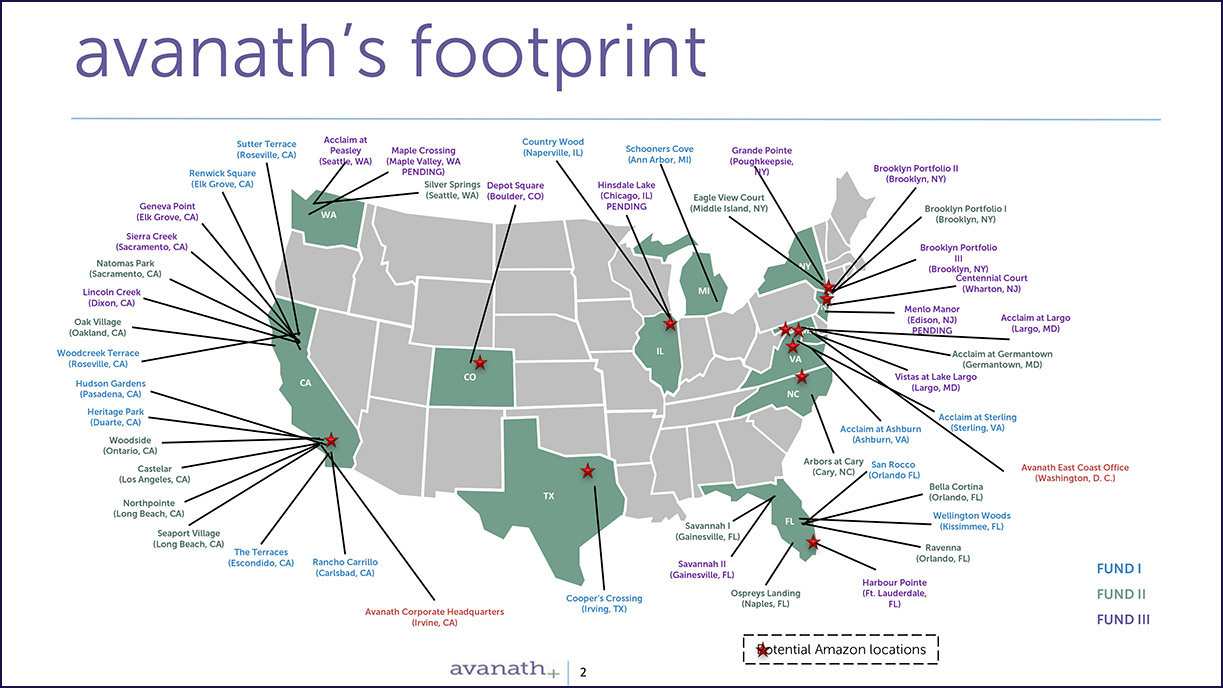

Daryl directs the strategy, investments, and overall operations of the firm. Over the past 2 years, Avanath has acquired in excess of $300 million in affordable apartment communities nationwide.

He has 32 years of experience in the commercial real estate industry. Previously, he was an Executive Managing Director of Centerline Capital Group (“Centerline”) and head of the Commercial Real Estate Group.

He holds dual Masters Degrees in Architecture and Management, both received from the Massachusetts Institute of Technology, as well as a Bachelor of Science degree in Architecture from the University of Michigan.

He’s a Trustee of the Urban Land Institute, Executive Committee Member and Chairman of the National Multi Housing Council, and a Past Chairman of the Commercial Board of Governors of the Mortgage Bankers Association.

CLICK ON ANY IMAGE TO ENLARGE

Lifestyle within Reach:

How to Create Housing for the American Workforce

PRESENTED AT HOME1 LAUNCH EVENT

NEW YORK, NY • FEBRUARY 27, 2018

As an owner and operator of affordable apartment communities across the U.S., I am on the front line of serving hard-working families that make $30,000 to $70,000. Most of these families are in high cost locations on the 2 coasts such as New York City, Washington DC, Los Angeles, and Seattle.

I have been asked to speak to you about how we create housing for the American workforce. At my company, Avanath, it’s not just about creating quality apartment units. Our mission is to provide each of our residents a great lifestyle within reach.

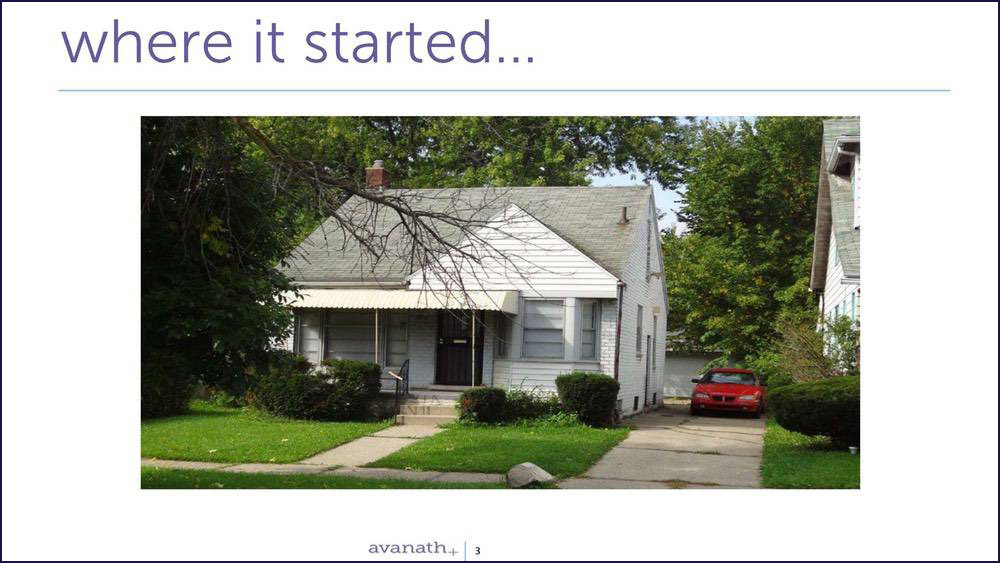

Much of my thinking about housing was formulated at my home on the West Side of Detroit, pictured here.

About 850 square feet, this home housed anywhere from 5 to 8 individuals – my parents, 3 kids, and at various times, grandparents, uncles, aunts, and cousins.

My parents were from Mississippi and migrated north to pursue better opportunities. My dad was an auto worker, my mom was a nanny. In 1967, they paid $14,500 for this home. My parents’ combined income at the time was $16,000 per year – so spending only 10% – 15% of their income fully repaid their mortgage 10 years later. Today, of course, home prices are typically 10 to 20 times the median incomes in many markets.

Once they bought this home, it became a base for upward mobility for other family members moving from Mississippi – typically their siblings or adult nieces or nephews. So, our home was the transition home for several uncles, aunts, and cousins. Both my parents worked, so during their transition period, one of the aunts, uncles, or cousins helped with us kids. So, my home had a child care system.

When my grandparents needed additional care, they moved in. My parents made sure that our grandparents were well cared for in our home and received necessary medical treatment. So, our house also had an assisted living function.

So, this house, along with a strong family structure, not only provided shelter, it incubated new households, and provided child care and assisted living. Bottom line, my home was a game-changer for me.

By way of background, our business model is to preserve older rental housing. Nationally, we lose some 100,000 housing units a year, all serving the lowest income Americans. Some properties we acquire have toxic conditions – lead paint, poor plumbing, unsafe electrical wiring, and inadequate fire-safety systems. We mitigate these conditions and make this housing functional, attractive, and safe.

So, with this as a backdrop, how to we create quality workforce housing? What is our recipe? There are 4 key ingredients to our strategy that I will now share with you.

First, we invest not only in the brick and mortar, but invest in services that support our residents. The current administration is mandating that recipients of government housing assistance must be employed. This mandate is a bit strange – as the bulk of our affordable residents work. At our properties, 90% of the Section 8 voucher recipients work. The 10% that do not work are elderly or disabled.

As parents are working long hours, typically until 6 – 7 pm, school buses are pulling up and droves of kids arrive at 3 pm to empty homes.

At many of our communities, we provide after-school programs for our children. These programs are activity focused – homework assistance, arts and crafts, and organized sports.

We acquired Northpointe Apartments in Long Beach, California in 2014, a 528-unit property. This property had many challenges, at acquisition, including gang issues. We learned that we had over 1,300 children living there, with few activities for kids. So, we created multiple activities for our kids, including an after-school program that attracts as many as 250 children each day.

Additionally, we took a vacant site and created this basketball court and have organized basketball programs and other sports activities for our young residents.

The second ingredient to our recipe is that we treat our residents with respect and make every effort to provide superior customer service. We are the caretaker of their homes, as they work hard to pursue their American Dreams. We try to bring the best practices in the apartment industry to the affordable sector of the market. For instance, we created a phone app for our residents to use for maintenance requests, rent payment and other service needs.

Our communities are highly diverse, with multiple ethnicities, religious beliefs, and cultural norms. We understand our multicultural communities because we are a highly diverse organization.

Very few companies have a leadership team that looks like this. A note to all of you – we must drastically improve diversity in the housing industry.

Third, we do “smart renovations” and value engineer every renovation, with the goal of optimizing affordability. Here are before and after pictures of a community that we renovated in Orlando.

We installed new appliances, including washers and dryers. We retained the existing cabinets – just resurfaced them and installed new hardware. Replacing the cabinets would add $10 – $15 in rent, versus our improvement, which adds less than a dollar in additional rent. One thing that is not shown in the picture is the old-fashion, popcorn ceiling. We have investors that see this and say, “Wow, it would look so much better if you resurfaced the ceiling.” My reply, resurfacing it would add $40 – $50 in rent. Everyone can now attain a $300 big screen TV from Costco – and are looking at their TVs, not the ceiling! Bottom line, in this renovation, we spent approximately $11,000 per unit. But, most importantly, we retained about 80% of our existing residents and kept the rents affordable to those that make 60% to 80% of area median income.

One other note about our acquisition and renovation strategy. We like to acquire properties with larger apartments or properties that we can convert to larger apartments. We love both 3 and 4-bedroom units. Since 2000, only 8% new apartment supply is comprised of 3 bedroom or larger units. While there is much focus on smaller units for millennials, we find that the strongest demand for affordable/workforce apartments is for larger apartments that house multigenerational families. Like my home in Detroit, our larger apartments provide solutions for both child care and assisted living for seniors.

The fourth and final step in our recipe to create quality workforce housing is to foster community and civic engagement. The prevailing wisdom is that homeowners are more politically engaged, than renters – and therefore our elected officials are more responsive to homeowners. Part of the challenge is that few owners of rental housing facilitate resident forums – out of fear that they will organize against them.

At Avanath, we have learned that creating forums for our residents to interact with elected officials at all levels generates positive results.

We now have research that supports the fact that our resident forums are transformative.

The USC Center for Religion and Civic Culture did a study of two of our apartment communities in Long Beach, California, Northpointe and Seaport. These properties comprise almost 900 apartment homes and make up about 85% of a voting precinct. We initiated these resident forums with elected officials upon acquiring these properties 4 years ago. The voter turnout prior to our resident forums was 9.5% or less. In 2016, the voter turnout was 50.4% — a 5 times increase in voter turnout. This is powerful!

In conclusion, we strive to deliver quality affordable rental homes to our residents, while providing a market rate of return to our investors. Our challenges are great, but so are the opportunities. We estimate that there are 3 – 4 million rental units that serve working class families that need new capital investments, physical renovations, and better management. My company is taking on this challenge and would welcome more companies to take on this challenge. Bottom line, our success will be determined not only by the buildings we improve, but by the lives we positively impact. My American dream started in a modest bungalow on the West Side of Detroit. It is my hope that we have created a home for each of our resident to achieve their dreams.